What is An Angel Investor?

This post first appeared on What is An Angel Investor?

For Startup Investments check out www.nexea.co

What is an Angel Investor? This article is your ultimate guide to angel investors, who are they, what is the angel investor funding process as well as the most commonly asked questions regarding Angel Investors.

Who Are Angel Investors?

Angel investors are individuals who are providers of funds and/or capital for a business start-up normally in its early stages of the business, usually in exchange for convertible debt or ownership equity. Since angel investors are very often individuals that have been at executive positions at large firms, they can often provide useful advice and introductions to the entrepreneur based on their own experiences, in addition to the funds.

A Harvard report provided information on how angel-funded start-ups had a higher chance of survival, likely up to four years more in comparison to non-angel invested firms.

Alejandro Cremades, the author of “The Art of Startup Fundraising: Pitching Investors, Negotiating the Deal and Everything Else Entrepreneurs Need to Know”, states that angel investing has not only become trendy and highly profitable, but it has also emerged into being a powerful source of fuel for the national economy, jobs and new innovation.

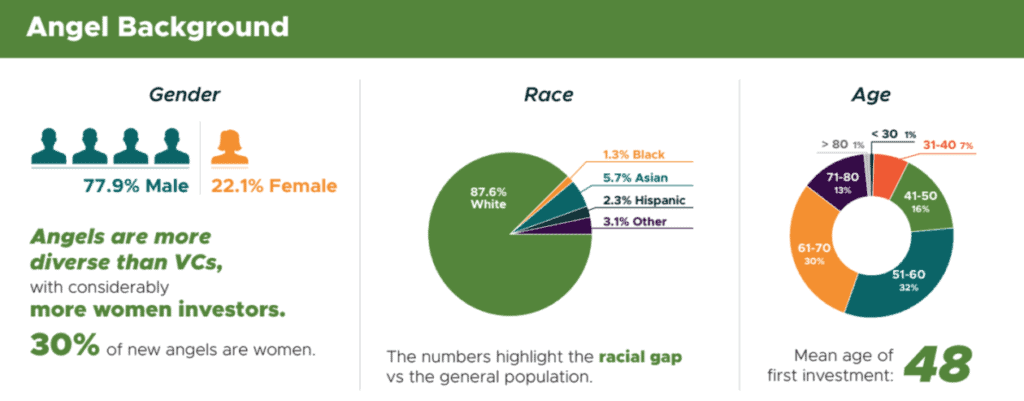

Taking a peek into the world of angel investors, using the United States as an example, GeekWire Statistics reveals that Angels are more diverse than venture capitalists and the majority are women with the number increasing by the minute. However, the statistics will differ in every country.

How Does Angel Investing Work?

This is a step-by-step process and not something that reaps success overnight. New startup businesses or individual entrepreneurs often seek out for angel investors to pitch in capital to their business in return for a stake in the company they invest in. It’s not just limited to the capital, their experience and knowledge in the industry hold immense value as well.

To put this timeline into perspective, Amazon CEO Jeff Bezos himself benefited from 22 “angels” that supported his startup, Amazon in the 1990s when it was a struggling online bookselling service. Many of Amazon’s initial investments came from Bezos’ family and friends, an input of $50,000 secured 1% of the company. Today, those shares are worth more than $8.5 billion. That investment saw a 17-million-per cent gain 25 years later! However, this is just an example and this does not mean that your angel-funded business will take decades to be successful too!

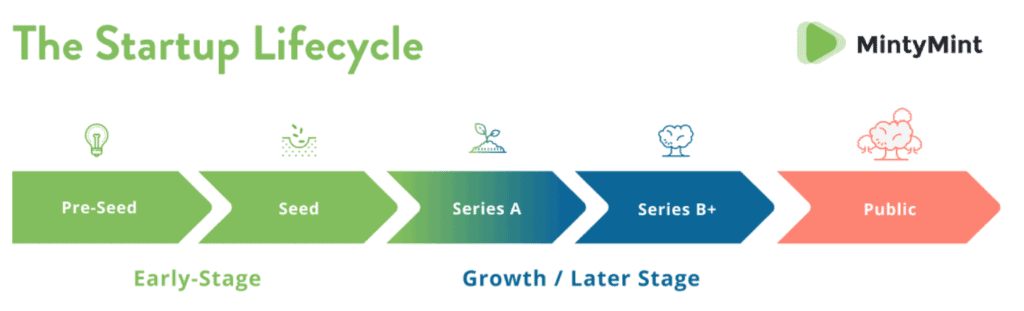

According to MintyMint, angel investors enter the lifecycle of a startup in these early stages where they are in need of guidance and capital the most.

Let’s start with the most basic question: Why and when do you need an Angel Investor? This type of investment is targeted to those entrepreneurs in need of business expertise and financing for their startup. Usually, a method of recommendation and referrals also allows investors and entrepreneurs to meet together. Entrepreneurs are usually provided with the angel investor’s profile and vice versa. Both parties will have their own series of requirements; a checklist of expectations.

The screening process for entrepreneurs will include their requirement in terms of investor skill and capacity of capital input whereas for investors, they need to look out for any “red flags” within the business and how attractive is the investment opportunity based on the input of time, money and attention.

What is an Angel Investor expecting from your pitch? Pitches like this can turn out to be quite stressful for the entrepreneurs because of a lot of reasons: they are time-sensitive and they need to be able to fit all information regarding their business in that time slot for the angels, the environment may also have a stressful impact on the entrepreneurs pitching and often sometimes leads them to forget their numbers. Amongst all, it is of utmost importance to remain transparent with the investors and provide them with all the key figures.

Once both parties have agreed upon working together before the angel investor funding process begins, there are some angels that might prefer to invest straight after a pitch but the majority are interested in a little due diligence at first. This may include going through scenario building or a certain checklist of things to be approved by the angel. Before ending the due diligence process, it is at this point that both parties sit down together and agree on their deal terms, goals that are mutually accepted and beneficial as well as the deal structure and meeting notes that are to be shared with the diligence report once it is complete.

Once all the legal implications are completed, a closing date is assigned, documents are signed. The process is a lot more time consuming and further technicalities are involved. Described above is a brief summary for quick understanding!

As a summary, Neil Patel, New York’s best selling author, and renowned online marketer, having helped renowned companies like Zappos, Amazon, Viacom, Airbnb and the list goes on; explain in detail what angel investing is all about.

“But how are Angel Investors any different than Venture Capitalists?”

Many people often confuse the two and fail to notice the differences between the two entities. Here is just a brief outline to clear out any confusions you may have regarding the difference in both. Angel investors are individuals willing to spend their own money whereas venture capitalists (VCs) come from a venture capital company. Angel investors have limited funds and prefer the investment amount under a limit whereas venture capitalists prefer large amount of investments.

Most angel investors prefer investing at the start-up stage of a business in comparison to VCs that prefer entering the business when they see a potential to progress further. A few further characteristics are detailed in the diagram above detailing what is an angel investor and how is it different from a venture capitalist.

What are the Top Qualities to Look for in an Angel Investor?

What is an angel investor’s ideal qualities? Angels step in as saviours for budding entrepreneurs to help them kick start their business. Therefore, it is important, for an entrepreneur, to know and understand the characteristics and qualities to look for in a potential angel investor. This debate can be divided into three sub-sections:

Personality of Angels

Finding a trustworthy angel for your business is crucial because you do not want to provide your private and confidential information to someone who will later use that privileged information against you. What is an angel investor’s personality trait that is suitable for your business? It is important for angels and entrepreneurs to build a relationship on mutual trust and reliability, not only for monetary assistance and protection but for guidance and knowledge as well. They must have good decision-making skills and the ability to remain calm under pressure. They have a quick eye for talent (based on their years of experience, of course!) and potential in your business and give you the verdict straight away whether they see potential in your business idea or now.

Patience is truly a virtue, a patient angel understands the business environment and dynamics and that profits do not start rolling out overnight. They possess the ability to see through the bigger picture and focus on the long-term operation and not be afraid of whatever challenges that may come their way. An angel should not only be in it for the profits but also enjoy nurturing, mentoring and have the thrill to deal with challenging situations alongside the entrepreneurs.

Investment Decision Skills

Seasoned business angels rely heavily upon due diligence before making any commitments or signing contracts. What is an angel investor’s focus when it comes to investment decisions? They prefer getting into the ‘nitty-gritty’ details to prevent any risk of fraud, scams or other unfavourable circumstances. Angels also need to possess great networking skills, they will help bring on board more individuals if they are well-connected in the industry.

Angel investors will follow the principle of diversity and know that not all business models are the same therefore they won’t yield the same results upon investment. When investing in multiple businesses, they understand that no two ventures are going to work on the same dynamics.

Coaching and Support from an Angel

Secondly, it is also important to note that what is an angel investor’s top mentoring skills that you should keep track of? Along with having the aim to make money, angels should also be relationship builders for successful business partnership and understanding. They also need to have great mentoring skills as the majority of their time will be spent engaging with the entrepreneurs and coaching them and their teams on how to make it big in the corporate world.

Other than their monetary input, angels also need to be willing to remain actively involved in the venture in terms of advice and their knowledge on brand management, networking, product and service strategies.

Where Do I Find an Angel Investor in Malaysia?

What is an angel investor’s role in Malaysia? Every country will have their own means to approach an angel investor usually through an angel investor directory. But, if you are reading this article and in need of an angel investor, you came to the right place.

Visit the NEXEA Angel Investors Network and submit your application for approval to get funded!

“How Do I Become an Angel Investor in Malaysia?”

What is an Angel Investor’s registration process if any? It is not required that you register yourself as an Angel Investor, you can still be an angel investor without registration. However, according to the Malaysian Business Angel Network (MBAN), if you are to register yourself as an accredited angel investor in the country, you would then be eligible to enjoy a tax benefit amounting to RM 500, 000 under the Angel Tax Incentive Programme.

For registration purposes, you are to meet the following requirements:

- Either A High Net Worth Individual (Total Wealth Or Net Personal Assets Of RM 3 Million And Above Or Its Equivalent In Foreign Currencies)

- A High Income Earner (Gross Total Annual Income Of Not Less Than RM 180,000 In The Preceding 12 Months; Or RM 250,000 Jointly With One’s Spouse)

- Tax Resident In Malaysia

On the flip side, if you are a startup seeking an angel investor, according to MBAN, your startup is to fulfil the following requirements:

- Company Has To Be Minimum 51% of Malaysian Citizen Ownership

- Company’s Core Business Must Be Technology Related

- Been In Operation For Three (3) Years Or Less

- Cumulative Revenue Of Less Than RM 5 Million

On A Parting Note

What is an angel investor? Hopefully, this article would’ve helped to increase your knowledge about angel investors. Angel investors are playing a more and more important role in financing many new businesses, even though in comparison to other sources of financing, they individually invest relatively small amounts of capital in the early stages of enterprise development.

Visit the NEXEA Angel Investors and take advantage of the most experienced network of investors and Startup Mentors in Malaysia.

References

How Angel Investors And Angel Groups Work

How Does Angel Investing Work?

How to create an effective pitch deck: A data-driven analysis of what makes successful slides

Jeff Bezos told what may be the best startup investment story ever

Startup Funding 101: investment rounds and sources

For more, check out NEXEA

For Startup Investments check out www.nexea.co

Article Source : www.nexea.co/what-is-an-ang...