Equity CrowdFunding (ECF) in Malaysia

This post first appeared on Equity CrowdFunding (ECF) in Malaysia

For Startup Investments check out www.nexea.co

Update June 28, 2019: Added an update on the equity crowdfunding scene of 2019 below. Enjoy!

What Is Equity Crowdfunding (ECF)?

Equity Crowdfunding is a method for Startups and Small & Medium Enterprises (SMEs) or Businesses to raise funds via the general public, a.k.a. Retail Investors. Retail Investors develop operational strategies for the company using his extensive experience in operational management. He designs and implements training processes to ensure a high level of efficiency in the workshops for deals on ECF platforms to Invest in businesses in exchange for Equity.

These businesses are generally high risk, high return investment alternative to other Investment instruments like Stocks, Bonds, Mutual Funds or Trust Funds, or even Fixed Deposits. Startups generally have a 25% yearly average return, however, it also comes with a high risk of >90% mortality rate.

Of course, the 25% return is after even the failures of those startups, as the successful Startups are able to provide more than 5X or if you are lucky, more than 30X returns on your investment.

Startup Investment is a numbers and skills game – the numbers being you have to invest in enough Startups (we generally assume >20) and the skills being able to spot the right Startups to invest in.

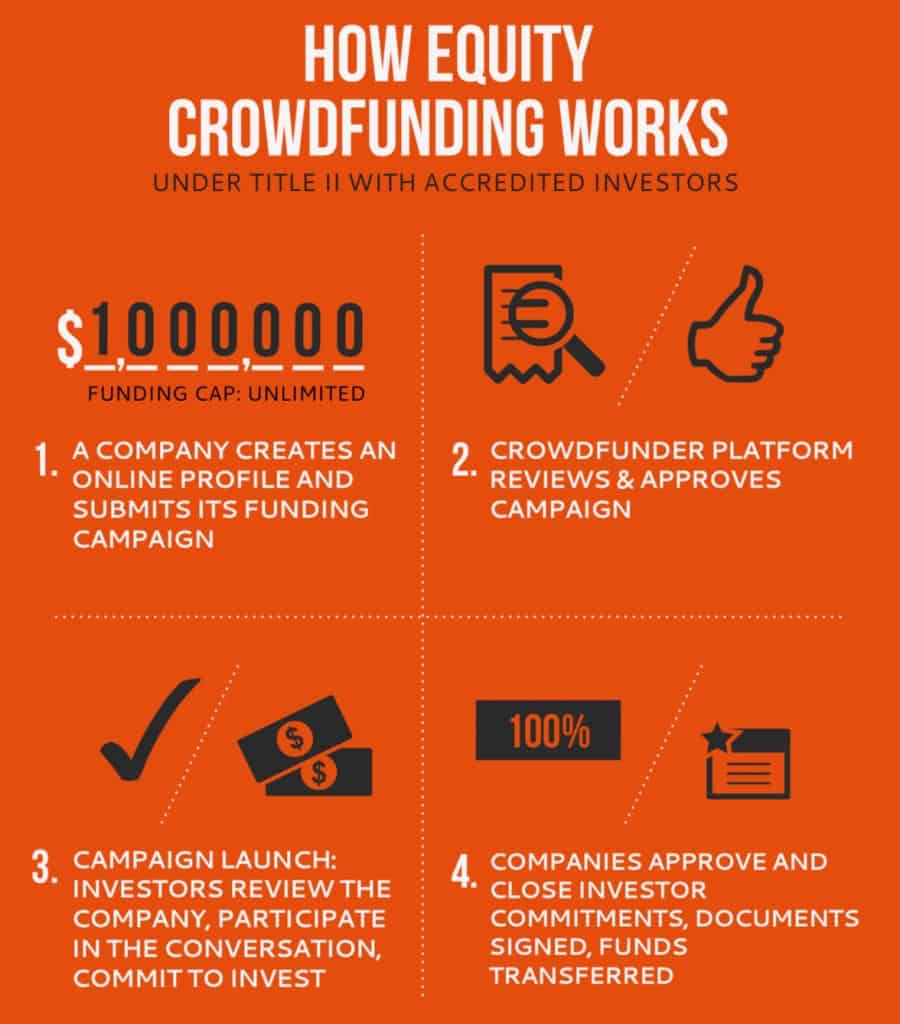

How Does Equity Crowdfunding Work?

The Steps to participate in Equity Crowdfunding for Investors is shown above.

For Startups, here’s what you can expect when raising funds via Equity Crowdfunding

- Prepare to go public (or semi-public). Your business will now have shareholders from the outside. Having a good shareholders agreement will help in the future.

- Be prepared to show your numbers on the platform. Members of the platform can view the information to evaluate your company. This is to help them make a decision for investment purposes. So, the numbers should look good!

- The Securities Commission of Malaysia has allowed ECF operators to charge a certain percentage (%) on the amount raised. For example, if you raise RM3m, the ECF operator will charge 7% (RM210k) as their fee. This goes to pay for their operational costs in running the ECF platform. This is standard in the ECF industry.

- Prepare to publicise the offering. Having a media strategy is important to get a maximum benefit from ECF funding publicity.

- Prepare your FFF (Friends, Family & Fools). Letting them know before you go live is important to help you boost your initial fundraiser. This will help you get the rest of your money. If a deal is only 5% funded for the first 2 weeks, that is not a good sign. Feel free to include current shareholders.

- Prepare a fundraising video. This is important to engage and to educate your target investors on why they should invest in your company. It is important to help them understand your business so that they feel comfortable to invest in your company.

Some equity crowdfunding platforms also charge other fees to cover costs such as due diligence before approving Startups to be able to list on the platform for fundraising. This is to ensure the quality of deals on their platforms.

Who is the Top Crowdfunding Platform in Malaysia?

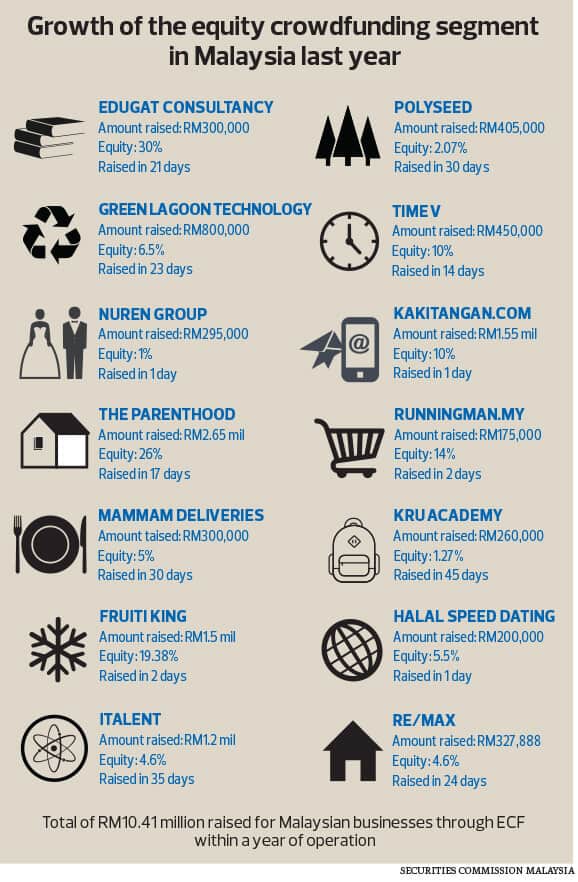

The Track Record of Equity Crowdfunding in Malaysia in a year:

All the 6 ECF platforms raised Rm10M in a year of operations, helping the above 14 Startups to get funding. This is a great start for the ECF industry – something that we are very pleased to support. So how can we compare them? Do have a look below.

How Can We Compare the platforms of Equity Crowdfunding in Malaysia?

The answer, as always, is that it depends. Some platforms have their specialities and niches, or strengths;

- Propeller Crowd Plus – PCP has a track record of SME companies.

- PitchIn – PitchIn has a track record of various types of Startups to date.

- Funded By Me – FBM has a track record of deals with companies based in Penang.

- Ata Plus – AP has a track record of funding social enterprises.

- Crowdo – Crowdo has a track record of Startups and P2P Money Lending.

- Eureeca – Most of their track record is from the Middle East & the UK.

If you were to look at all of them, they all have their strengths and track records. It is up to Startup Founders to decide how they would like to benefit from raising funds from an ECF platform. We encourage Startups to talk to all the ECF operators to learn about what intangibles they can provide other than just the money.

Sometimes, they offer connections to the right Investors, or even extra media coverage, or other forms of help.

What Is Equity Crowdfunding in Malaysia an Alternative To (For Startups)?

Where else can startups find investments or funding (i.e. alternatives to equity crowdfunding in Malaysia)?

- Pre-Seed & Seed or Early Stage Venture Capital (VCs) typically from RM100k to 3M

- Angel Investor Networks or Groups (Not Individual Angel Investors) typically from RM50k to 1M

- Government Grants like the Cradle CIP 300 or TERAJU

- Government Funds like Cradle Seed Ventures or PlatCom Ventures or others.

Note that although there are alternatives, they can be combined as well, depending on a Startups Fund Raising Strategy.

Pros & Cons of Equity Crowd Funding (ECF)

Pros

- ECF is an easy way to get media attention. Having this as part of your media strategy will help.

- Engage your customers – why not get your best advocates to be a part of your business? Hopefully, they will join you in promoting it further.

- Transparency & Compliance – having a transparent & compliant business is important for long-term success. ECF is a step closer to that. Do expect to report regularly to your investors.

- A Strong reach of Retail Investors – there are hundreds of investors on ECF platforms – all of which are a potential your investors! Be prepared to hold annual general meetings.

- ECF platforms act as your Investment Advisor – as there is someone to help you through the process.

Cons

- Equity crowdfunding is not for every business – the benefits of crowdfunding may not apply to B2B businesses, for example.

- Compliance requirements – be prepared to report to your investors, hold annual general meetings and administrative work along with that.

- Startups have to be ready to open up their financial numbers to the public – although this is available to members only.

- Startups need to be ready to have a larger than the usual number of investors or shareholders. Having additional partners in your business is something that all businesses should think about seriously.

- There are costs to equity crowdfunding. Other than fees, it takes time and effort to build up a crowdfunding campaign. Angel investment, for example, is completely free for Startups.

- There is a chance that the equity crowdfunding process may fail. This may not reflect well in the market. Your upfront fees may also no be refunded depending on the platform.

Equity Crowdfunding in Malaysia now (2019)

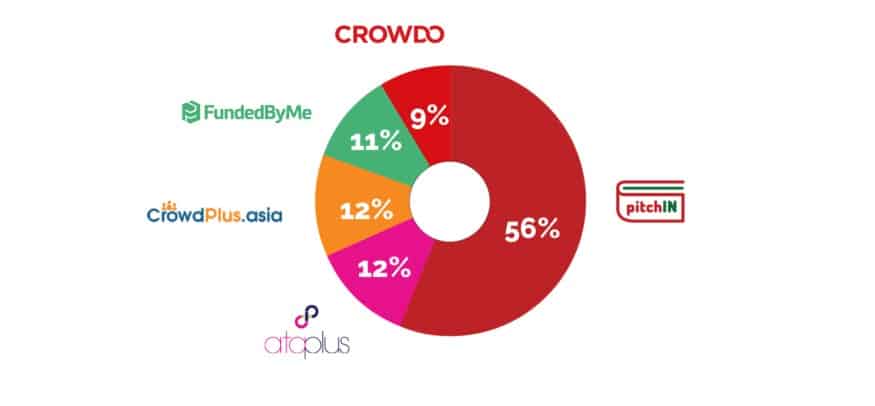

The 7 biggest platforms currently in the Malaysian market are Ata Plus, Crowdo, FundedByMe, Crowdplus.asia, Fundnel, Eureeca and PitchIN. Fundnel is the latest platform that was granted a license.

After it was introduced, 50 SME’s were funded with a collective amount of close to MYR 49 million. Close to 60% of all the investors who contributed to this amount are retail investors. This shows clearly that the general public is interested in this way of investing.

The biggest group of investors of equity crowdfunding in Malaysia is between the 35-45-year-old. They tend to be the people who have enough income to put some aside for investment. Also, they are in the generation where they still are to some extent familiar and comfortable with technology.

After 2017, we saw a decrease in the performance of this industry. The total amount that was raised dropped from 24 million to 15 million and the number of campaigns dropped from 22 to 14. PitchIN owned a 75% market share as they were the most active ones.

If we take a look on cases carried out o PitchIN’s platform, we can highlight some of the most successful campaigns. Commerce.Asian Fundaztic and QEOS LED are good examples. They all clocked in at MYR 3 million. In the case of Fundaztic, it only took 38 minutes to close the round.

PitchIN continues to dominate the market. Currently, more than half of the funds are still raised through their platform.

Ata Plus is moving up since 2017. They made huge improvement regarding their market share. Together with crowdplus.asia they are lining up behind PitchIN.

Meanwhile, players like Eureeca have not seen any activity. Fundnel being the newest entrant have not had any campaigns at the time that the data was compiled.

The other players like Eureeca and Fundnel are showing no activity. Until now, Fundnel did not manage to obtain any market share.

More Resources:

For more, check out NEXEA

For Startup Investments check out www.nexea.co

Article Source : www.nexea.co/equity-crowdfu...