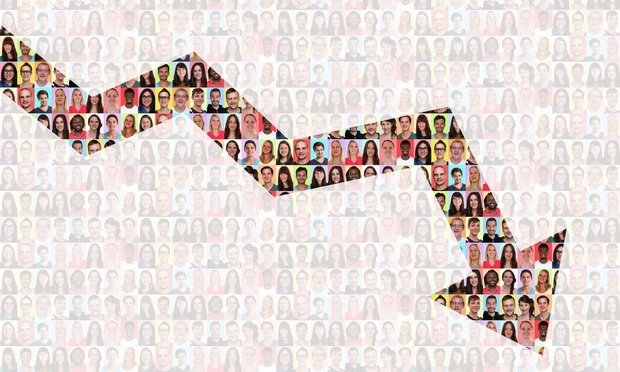

NYC Investment Activity Drops to 10-Year Low

Funding gross sales volumes have dropped to a 10-year low in Manhattan. A brand new report from Avison Younger exhibits that funding gross sales exercise totaled $1.1 billion throughout 21 transactions within the third quarter, the bottom in a decade out there and a 74% lower from the third quarter in 2019.

Multifamily transactions led the funding exercise with 9 complete transactions, by far essentially the most transactions of every other asset class. These offers totaled $121 million. Regardless of serving because the market chief, multifamily gross sales exercise was down 55% and greenback quantity was down 82% year-over-year. Cap charges elevated barely to five.01% and the worth per sq. foot fell to $553, a 40% decline. This exhibits that there was a pricing adjustment for multifamily property out there—for these nonetheless transacting. SL Inexperienced’s sale of 400 East 58th Road to A&E Actual Property Holdings was the highest multifamily deal. The property traded for $62 million, equating to $443 per sq. foot and a 5% cap charge.

Growth properties accounted for six of the transactions from the quarter, totaling $141 million. Curiously, the gross sales transactions had been truly a 50% enhance year-over-year, however pricing was down 56% in comparison with the third quarter 2019. Actual Property Equities Corp. bought a 99-year floor lease of an assemblage at 156-166 Bowery for $50 million, the main transaction within the sector. The location totals of 90,000 base sq. toes, which is $556 per buildable sq. foot.

Solely a single property in each the workplace and retail classes traded palms throughout the quarter. In workplace, Savanna Companions bought a 513,401-square-foot workplace constructing at 1375 Broadway for $435 million, or $847 per sq. foot, which equates to a 4.8% cap charge. Regardless of the massive sale, greenback volumes in workplace declined 79% for the quarter and the worth per sq. foot fell 36%. Transaction quantity fell 89%.

In retail, the only transaction was 152 Franklin Road, a retail rental location that was bought out of foreclosures for $1.5 million or $417 per sq. foot. Because of this, transaction quantity was down 83% and greenback quantity was down 99% in comparison with final 12 months. Worth per sq. foot fell 71%. Workplace condos and conversion initiatives accounted for the remaining Four offers to commerce throughout the quarter.

With transaction volumes down in each class and pricing down in close to each class, Avison Younger forecasts that transactions in Manhattan will complete 155 offers and $8.Four billion by the tip of 2020. This could equate to a 74% decline in transaction quantity and a 69% lower in pricing from 10-year averages and 46% and 52% decrease than 2019 volumes.

— to www.globest.com

The post NYC Investment Activity Drops to 10-Year Low appeared first on Correct Success.

Article Source : ift.tt/36OcEw3