An preliminary public providing (IPO) within the coming weeks will bear testimony to Ant’s development. It’s anticipated to lift greater than $30bn, eclipsing Saudi Aramco’s debut final yr as the most important IPO—a logo of the world’s transition from a century wherein oil was essentially the most precious useful resource to an period that prizes knowledge. With a ahead price-to-earnings a number of of 40, consistent with massive world funds firms, Ant might fetch a market capitalisation in extra of $300bn, greater than any financial institution on this planet.

Queen of the colony What Ant Groups IPO says about the future of finance | Briefing

IN THE STAID world of Chinese language banking, it’s uncommon for executives to voice public criticism. So Jack Ma, the founding father of e-commerce large Alibaba, made headlines in 2008 when he bemoaned how arduous it was for small companies to get loans: “If the banks don’t change, we’ll change the banks.” He has not repeated his warning since then. He has not wanted to.

By means of Ant Group, which started life as a funds service on Alibaba, Mr Ma’s impression on the Chinese language monetary system has been profound. Ant has helped set up China because the world chief in digital transactions, given entrepreneurs and shoppers far higher entry to loans, and altered the best way that individuals handle their cash. It’s now an enormous in its personal proper. Over the previous yr it counted greater than 1bn lively customers. Final yr it dealt with 110trn yuan ($16trn) in funds, practically 25 instances greater than PayPal, the most important on-line funds platform outdoors China (see chart 1).

A four-legged insect

Extra essential than its dimension is what Ant represents. It issues globally in a means that no different Chinese language monetary establishment does. China’s banks are enormous however inefficient, burdened by state possession. In contrast overseas financiers take a look at Ant with curiosity, envy and anxiousness. Some hawks within the White Home reportedly wish to rein within the firm or hobble its IPO. Ant is essentially the most built-in fintech platform on this planet: consider it as a mix of Apple Pay for offline pay, PayPal for on-line pay, Venmo for transfers, Mastercard for bank cards, JPMorgan Chase for shopper financing and iShares for investing, with an insurance coverage brokerage thrown in for good measure, multi function cell app.

Given the abundance of shopper knowledge in China and the comparatively lax safeguards round its use, Ant has extra to work with than fintech friends elsewhere. Greater than 3,000 variables have gone into its credit-risk fashions, and its automated methods resolve whether or not to grant loans inside three minutes—a declare that will appear far-fetched however for Alibaba’s confirmed capacity to deal with 544,000 orders per second. Ant is, briefly, the world’s purest instance of the super potential of digital finance. However because it advances additional, it might even be an early warning of its limitations.

Begin with a deceptively easy query: what’s Ant? In its decade as an impartial firm it has modified names thrice—from Alibaba E-Commerce to Ant Small and Micro Monetary Companies to Ant Group. The corporate as soon as referred to as itself a fintech chief. Then Mr Ma inverted the time period to techfin, so as higher to seize its priorities. Such are its efforts to differentiate itself from a purely monetary agency that it has requested some brokerages to assign tech analysts to cowl it. (After all, it doesn’t damage that the valuations for tech shares are a lot plumper than for financial institution shares.)

But there isn’t a doubt that Ant, at its coronary heart, is about finance. The clearest means of understanding its enterprise mannequin is to have a look at the 4 sections into which it divides its revenues. The primary is funds—the way it began and nonetheless the muse of the corporate. Ant started in 2004 as an answer to an issue. Buyers and retailers had been flocking to Alibaba however lacked a trusted cost choice. Alipay was created as an escrow account, transferring cash to sellers after patrons had obtained their merchandise. With the launch of a cell Alipay app, it moved into the offline world, super-charging its development in 2011 with the introduction of QR codes for funds. A store proprietor wanted to indicate solely a QR code print-out to just accept cash, an enormous advance for a rustic beforehand reliant on money.

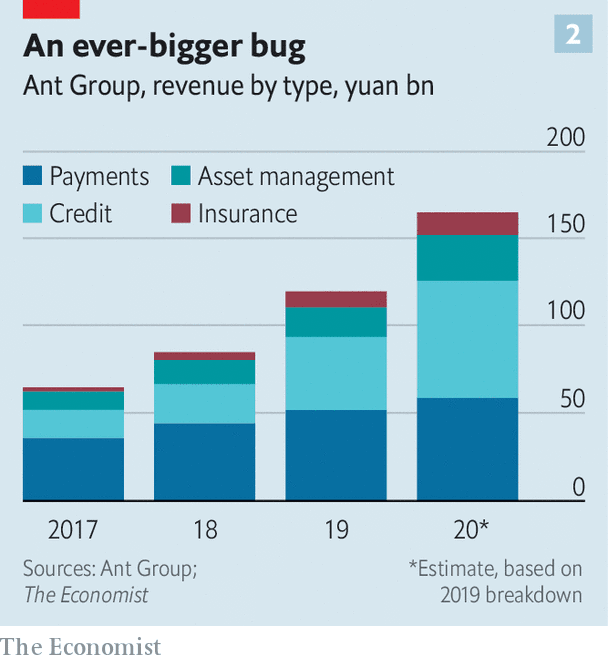

For China as a complete, digital transactions reached 201trn yuan in 2019, up from lower than 1trn in 2010. Alipay’s market share has been whittled down by Tencent, which added a funds perform to WeChat, China’s dominant messaging app. Each firms earn as little as 0.1% per transaction, lower than banks do from debit-card swipes. Given the sheer quantity, this nonetheless provides as much as rather a lot. Ant generated practically 52bn yuan of revenues from its funds enterprise final yr. However development is slowing, dropping from 55% of Ant’s income in 2017 to 36% within the first half of this yr. As an alternative, the essential level is that funds are a gateway: how Ant attracts customers, understands them and finally displays them.

The largest beneficiary of all this knowledge is Ant’s lending arm, the second a part of the corporate (which Ant, by no means one to shrink back from jargon, calls CreditTech). Ant started shopper lending as not too long ago as 2014, with the launch of Huabei, a revolving unsecured credit score line for purchases—mainly a digital bank card. Alipay customers can faucet into Huabei to defer funds by a month or to interrupt them into instalments. Bank cards had by no means taken off in China, so Huabei was lapped up. That led to Jiebei, an Alipay characteristic which permits customers to borrow bigger sums. Ant additionally gives loans, with a concentrate on very small companies. Annualised rates of interest hover between 7% and 14%, decrease than the options from small-loan firms.

Like many Ant purchasers, Zhu Yifan, proprietor of Rabbits Go House, a comfort retailer in Dongyang, an jap metropolis, began small. 4 years in the past she and her husband needed to open their retailer. With no property as collateral, they may not get a financial institution mortgage. As an alternative, they pulled collectively cash from associates and family, and, on a whim, borrowed 10,000 yuan from Ant, essentially the most they may acquire then. By repaying that preliminary mortgage and getting prospects to make use of Alipay—giving Ant a take a look at her money circulation—Ms Zhu’s credit score rating improved. Now, she has a 100,000 yuan credit score line from Ant, which lets her replenish earlier than busy holidays.

In just half a decade Ant has reached 1.7trn yuan in excellent shopper loans, or roughly a 15% share of China’s consumer-lending market. Its loans to small companies whole about 400bn yuan, about 5% of the micro-enterprise mortgage market. From a monetary perspective, Ant’s greatest innovation is the best way that it funds the credit score. Initially, it made the loans after which packaged them as securities, bought to different monetary establishments. However regulators feared parallels with the securitisation growth that preceded the monetary disaster of 2007-09. They required that the originators of securities maintain capital very similar to any financial institution—a rule that reduce into Ant’s margins.

So Ant devised a brand new method. It now identifies and assesses debtors, however passes them on to banks which prolong the loans. Ant collects a “know-how service charge”. For debtors it’s seamless. With a number of faucets on their smartphones, their credit score requests are authorised or rejected. Ant finally ends up with a cash-rich, asset-light lending mannequin. Absolutely 98% of the loans are held as belongings by different companies. Credit score has develop into Ant’s greatest single enterprise phase, accounting for 39% of its revenues within the first half of this yr (see chart 2).

The energy of Ant’s platform is what allows its third and fourth enterprise segments: asset administration and insurance coverage (InvestmentTech and InsureTech, to make use of Ant’s nomenclature). Ant obtained began on asset administration in 2013 with the launch of Yu’ebao, or “leftover treasure”. The concept was that retailers or buyers with money in Alipay might get a small return by parking it in a money-market fund. That attracted individuals inquisitive about Yu’ebao purely for storing money, since its yields (now roughly 1.7%) had been increased than these accessible on present accounts at banks. By 2017 Yu’ebao had given rise to the world’s greatest money-market fund by dimension.

Ant broadened its choices to develop into certainly one of China’s strongest distribution channels for investments. Immediately 170 firms promote greater than 6,000 merchandise equivalent to inventory and bond funds on Ant. Altogether these companies have roughly 4.1trn yuan in belongings below administration enabled by the app. As with its lending enterprise, Ant screens potential purchasers and directs them to merchandise. It then collects a service charge. “Our development on Ant has been sooner than on another digital platform,” says Li Li, deputy CEO of Invesco Nice Wall Fund Administration. Her group’s two money-market funds soared from 665m yuan in belongings below administration in early 2018, when it began promoting them on Ant, to 114bn yuan in June.

Ant’s push into insurance coverage occurred extra not too long ago. For a decade it supplied delivery insurance coverage for purchases on Alibaba, letting dissatisfied prospects return items for no cost. However it’s only prior to now two years that it has utilized its asset-management template to insurance coverage. In partnership with massive insurance coverage companies, it has unveiled life, automobile and medical insurance coverage—once more amassing charges as a distribution platform. Asset administration and insurance coverage now make up practically 1 / 4 of revenues.

All of the ants are marching

Merely wanting on the numbers, Ant can seem unstoppable. It has chalked up dizzying development charges in each market that it has focused. It advantages from the community results so acquainted within the tech world: the extra individuals use it, the stronger its attraction for but extra debtors, lenders and traders. It’s a virtuous cycle, particularly for Ant’s shareholders. However, there exist three sorts of dangers that would gradual it down: regulatory, aggressive and people which might be intrinsic to its personal mannequin.

The regulatory panorama in China is treacherous. Officers endlessly tweak guidelines for banks and traders, patching up holes as they emerge within the fast-growing however debt-laden economic system. Many have lengthy assumed that the federal government will give Ant, a private-sector agency, solely a lot leeway within the state-controlled system.

Certainly, regulators have already put quite a few hurdles in Ant’s path. Its first try at launching a digital bank card was blocked. The securitisation crackdown upended its lending mannequin. A authorities plan to standardise QR codes might weaken it in funds, probably lowering Ant’s market dominance. One other new rule, taking impact in November, will pressure Ant to carry extra capital.

But when all these hurdles had been meant to cease Ant, they haven’t succeeded. So there exists another clarification. Regulators, cautious of the pitfalls in monetary innovation, proceed to erect guardrails round Ant. Usually, although, they prefer it. Not solely has it steered credit score in direction of small shoppers and companies, it has additionally given the federal government extra details about cash flows. Duncan Clark, creator of a biography of Jack Ma, notes that regulators have lengthy struggled to observe all corners of China, referencing the outdated saying that the mountains are excessive and the emperor far-off. “Ant has mainly let Beijing tunnel by the mountains and fly drones over their summits,” he says.

One other menace to Ant is its opponents. Till 2013 cell pay was, kind of, Ant’s unique area. However Tencent has used its ubiquitous WeChat app to muscle in, taking practically a 40% market share. Different companies even have monetary ambitions. Meituan, an app recognized for meals supply, now additionally gives credit score. The monetary arm of JD.com, an e-commerce agency, and Lufax, a web based wealth-management platform, are on monitor for IPOs this yr.

Thus far these opponents have a a lot smaller monetary footprint than Ant’s. Partly it is because they don’t have the identical breadth. Shawn Yang of Blue Lotus, a boutique Chinese language funding financial institution, says that Tencent, for example, has high-frequency however low-value consumption knowledge, much less wealthy than the trove that Ant has because of Alibaba, which accounts for greater than half of Chinese language on-line retail gross sales.

However it’s also a matter of enterprise tradition. Essentially the most controversial episode in Ant’s historical past got here in 2011 when Mr Ma spun it out from Alibaba, with out notifying SoftBank and Yahoo, which collectively held about 70% of Alibaba’s shares again then. Mr Ma defined that Chinese language laws forbade foreigners from proudly owning home funds companies, although there might have been work-arounds. Some suspected that he needed to herald highly effective traders nearer to dwelling. Ant’s earliest rounds of fundraising as an impartial agency did certainly entice main state-owned enterprises. A stake was additionally bought to a non-public fairness agency managed by the grandson of Jiang Zemin, China’s paramount chief throughout Alibaba’s early years.

But on reflection the spin-off has a transparent strategic rationale. As a standalone firm Ant has had the motivation to discover distant corners of the banking system and act aggressively. An govt with one other e-commerce firm says that its monetary unit worries about making errors which may taint the group’s core retail enterprise. Ant, against this, has diversified, with lower than 10% of its revenues now from Alibaba. For China’s different e-commerce dynamos, its success gives a template. They could be a number of years behind however the fintech race is much from over.

The ultimate hazard for Ant has essentially the most world resonance: the character of its mannequin. Unsecured lending to small debtors is dangerous, whichever means it’s carried out. Certainly the coronavirus pandemic has supplied a pointy take a look at for Ant. Delinquent loans (greater than 30 days late) issued by way of its app practically doubled from 1.5% of its excellent whole in 2019 to 2.9% in July. But that’s higher than most different banks in China. Is that due to Ant’s prowess? Some critics say that it displays its market energy. Given the centrality of Alipay and Alibaba to their operations, few dare to default on Ant loans, anxious {that a} downgraded credit standing might harm different components of their enterprise.

Nonetheless, many bankers are persuaded that Ant actually does have a bonus in its analytics. “They don’t want quarterly statements. They see your each day circulation of funds. They know who your buyer is. They know who your buyer’s buyer is,” says one. Based mostly on the deal with for e-commerce deliveries, Ant has extra up-to-date details about the place somebody lives and works than a financial institution. Based mostly on what that particular person buys, Ant can work out their earnings bracket and their habits, preferences and lifestyle.

However in accordance with Hui Chen, a finance professor at Massachusetts Institute of Expertise who has labored on analysis tasks with Ant, particular person and systemic dangers are completely different. The machine studying that underpins Ant’s algorithms observes particular person behaviour repeatedly, and is then in a position to detect patterns and anomalies. But when dangers don’t seem within the historic knowledge—say, an enormous financial shock—the identical machine studying might stumble.

There are additionally some limitations hard-wired into Ant’s technique. By design, it goals for high-volume, small-scale debtors and traders. “Their analytical benefit is most vital with this mass market, the place conventional banking fashions are most inaccessible,” says Mr Chen. Most company lending—about 60% of all credit score in China—will stay off limits. Ant additionally has an ungainly relationship with banks. It depends on them to fund the loans on its platform, however because it grows it might develop into a competitor of their eyes. For now that’s not a lot of a priority, provided that it focuses on debtors ignored by banks. But it surely implies that Ant should befriend the very establishments that it as soon as got down to disrupt.

Doubts exist about its funding and insurance coverage platforms, too. Ant has excelled in promoting money-market funds to a plethora of retail traders. Shifting up the worth chain might be tougher. “They’re nice at promoting penny merchandise. However that’s not the place you make the cash in insurance coverage,” says Sam Radwan of Improve, a consultancy. To shut a deal on a precious, advanced coverage like a variable annuity, brokers sometimes converse with shoppers a number of instances. “No atypical buyer goes to belief a web based dealer for one thing that difficult,” says Mr Radwan.

Doing the jitterbug

Ant’s world ambitions are additionally operating into issues past its management. It has stakes in round ten completely different fintech firms in Asia, equivalent to Paytm in India. Boosters as soon as imagined a world linked by Ant, its credit-to-investment structure straddling borders. The primary blow to that imaginative and prescient got here in 2018 when America blocked Ant’s acquisition of MoneyGram, a money-transfer agency, which might have established Ant as a pressure in world remittances. Safety issues over Ant have elevated as China’s overseas coverage has develop into extra aggressive. Little surprise that Ant plans to dedicate only a tenth of its IPO proceeds to cross-border growth.

Regardless of all these limitations, one lesson from Ant’s decade in existence is that future prospects stay huge. Ms Li of Invesco gushes about her fund-management agency’s mini-site throughout the Alipay app, one of many tens of hundreds of separate sections that represent the Ant ecosystem. In September Invesco hosted a live-stream on the mini-site to debate its market outlook. Greater than 700,000 tuned in—only one instance of how Ant has develop into the primary doorway into the monetary system for tens of hundreds of thousands of individuals. And for all those that have walked by it, many extra haven’t. Ant will quickly know the place they dwell, how a lot they earn and what they need. It’s coming for them. ■

This text appeared within the Briefing part of the print version below the headline “Queen of the colony”

— to www.economist.com

The post Queen of the colony – What Ant Group’s IPO says about the future of finance | Briefing appeared first on Correct Success.

Article Source : ift.tt/3luov6L