Banking is not something we do for fun. Even as adults, we still find ourselves stuck in the world of routing numbers and compound interests. Many people are not aware of standard banking terms or what they mean, even if they may have heard the term before. This is what life is like for many people, if not most. For banking institutions, this means that their customers may very well have no idea of what you are offering, which makes developing customer engagement strategies for banking somewhat complicated.

Customer Engagement Strategies in Banking

TABLE OF CONTENTS

Customer Engagement Strategies in Banking

Customer acquisition is the top priority for almost every banking institution bit, really, that is only the beginning of a long customer journey. Customer engagement is essential to develop a long-term relationship with your customers and to generate near-term profitability. Customer engagement is a delicate business, and you can not rush it as it may take days, weeks, or even months to generate the desired result through your campaigns.

When done right, customer engagement has the potential of becoming a pillar that holds up your relationship with the customers. Furthermore, it also plays a crucial role in establishing trust and steady growth of your business in terms of service ownership as well as the share of wallet (SOW). Therefore, meaningful customer engagement is not something that you can hope to achieve without actually putting in the work for it.

This article discusses customer engagement strategies in banking and how your financial institution can stay a step ahead of the competition with it. We also discuss the advantages of customer engagement activities in banking and discuss what you can do to improve your business’s customer engagement. We hope to educate you on the importance of customer engagement in retail banking and the steps you can take to master it.

Why You Should Use Customer Engagement Strategies in Banking

Customer engagement activities in banking have numerous benefits, which include harnessing a loyal customer base and forming an emotional attachment between you and your customers. But, that is just the beginning because customer engagement offers you more than just that. Below we discuss the major benefits you can get from employing effective customer engagement strategies in banking.

Boost Revenue, Wallet Share, and Product Penetration

According to the findings of Gallup research, typically, a fully engaged customer brings additional revenue of approx $400 per year to their banking institution. When it comes to wallet share, both deposit balances and investments saw much higher growth than the customers who are actively disengaged from their banking service provider. While the deposit balances grew their wallet share by 10% thanks to active customer engagement, the investment wallet share grew by 14%, according to the survey.

Furthermore, proper customer engagement also caused the customers to discover an average of 1.14 additional product categories with their primary bank. To positively affect the revenue, wallet share, and product penetration simultaneously is something every business dreams of, and customer engagement has made this dream a reality.

Boost Purchase Intent

When a customer is fully engaged with your banking institution, it not only enables you to open more accounts with your bank but also ensures that your bank is the first place your customers turn to for all their future requirements. We live in a digitally dominated world today, and almost all our shopping requirements are met through online mediums. Under these circumstances, being able to become the first option your customer considers when shopping online can be extremely beneficial to your banking business.

Become a Financial Partner

Although this is not part of the customer engagement benefits that are tangible and easily measurable, becoming financial is just as big an advantage as any other. As per the research by Gallup, the customers who were actively engaged with their banking service provider were observed to develop a certain bond with their bank or credit union.

The research also found that many of the customers (54% to be exact) are of the opinion that their banks play an important role in reaching their financial goals. But perhaps the most significant statistics from the research that’s worth mentioning here is that a whopping 71% of the actively engaged customers believe that they will use their current bank for the rest of their lives.

Tips to Optimize Your Customer Engagement Strategy in Banking

Regardless of how hard it is to create meaningful customer engagement, there are still ways you can make it easier for your business. Below, we are going to discuss a few simple tips that you need to keep in mind when creating a customer engagement strategy for your banking business. If you can create a customer engagement strategy after taking all the factors listed below, then you can be sure to notice the results in your customer engagements.

Enhanced Acquisition Targeting

You will be surprised at how often companies don’t get the desired results because of the flaws in their customer acquisition strategy. Customer engagement in banking begins even before a new customer opens his/her bank account. Thanks to today’s advanced technology and data processing capabilities, we are able to find potential customers who are very similar to your ideal customer persona.

You have the freedom to build acquisition models that are specifically tailored to your business requirements. You can choose to build acquisition models that consider specific products or services, financial behavior, and even relationship profitability. As a result, you can reduce the likelihood of opening new accounts that have limited engagement potential.

You must go beyond the typical acquisition models that use demographics, financial behavior, and product use as their criterion and expand it to geographic modeling. Geographic modeling is an important aspect of the banking sector because it is not necessary that the branch radius include the strongest potential trade areas. Using geographic modeling thus provides a more accurate targeting system.

Change up The Conversation

The initial talking stages can be crucial for establishing an effective customer engagement strategy and building a warm customer relationship. You need to put effort into building trust with your customers during the account opening process. And to do that, you need to come across as someone who is genuinely interested in the customer, someone who cares and is willing to look out for them.

You must also reassure the customers that they will be rewarded for their business/loyalty to your banking institution. One thing you can do is to make the conversation about the customer, their requirements, and their needs instead of focusing on the features or services that you are capable of offering. By doing this, not only do you successfully come across as someone who cares but also highlight your bank’s capability to help them.

During the initial stages, you must try to collect valuable insights from the customer, which includes finding their financial goals, the primary decision-maker of their financial expenses, their preferred channel of communication, and even find out if they have another account elsewhere. However, studies show that having such an in-depth conversation is harder than they sound and are seldom carried out effectively.

It is another instance where we see the age-old tale of quality over quantity, and you must always focus on the quality of the sales rather than sales quantity. Furthermore, you can make use of iPads to collect insight directly from the customer, which is a less intrusive way of gathering the required information. This further streamlines the process meaning that you can save valuable time.

Early And Frequent Communication

You may have noticed that, unlike most other businesses, most bans don’t go out of their way to reach out to their customers. In fact, it is not uncommon to see banks limit their number of interactions to as few as one time a month. Interestingly, this happens even when the customers show a genuine interest in interacting with their service providers, which is a great flaw in banking communication.

Now, if we were also to consider the research by J.D. Power which went on to state that during the first 90 day period, the ideal number of touchpoints should be seven. This number was arrived at after considering both the customer satisfaction and relationship growth perspective of the banking service provider.

The need for effective communication with your customers is essential in the banking sector, and you can use multiple channels for achieving this. A banking service provider must, at the very least, include a ‘thank you’ message in their communication engagement plan that is sent to the customer within the first five days of opening an account with your banking business.

Personalized Messages

Did you know that a mindblowing 50 percent of engaged customers receive mistargeted communications? What does it mean? It means that half the engaged customers receive communication about irrelevant products/services. It could mean that the customer already owns the product/service that you are pushing towards them, or maybe they just don’t align with their interests. This can be easily avoided if you’d just check these communications with the insights provided by the customer.

The truth is that every customer today has grown accustomed to well-targeted and personalized communications for pretty much every product/service they need. The least your banking business can do is live up to the customer expectations and deliver personalized communications. The customer provides their intimate information with financial service providers in the hopes of getting relevant communications that are beneficial to them and not get random offers on products/services they have zero interest in.

The best approach you can take is to build an engagement service sales grid capable of indicating what products and services should be highlighted based on the customer’s active products/services. The sooner you realize that the one size fit approach can not work for your banking business, the better it is for your business growth. Furthermore, banking service providers have the ability to provide offers to products/services that the customer actually wants, and this could effectively boost customer engagement.

Nurture Trust Before Selling

Trust is quintessential for the success of a financial service provider. In banking, trust is gained by providing all the necessary information so that the customer can make a well-informed decision. This must be followed for every product and service you try to sell to the customer. Remember that banking can be confusing and even overwhelming to the regular public, and they may not be aware of all the nick-nacks of the banking world.

If not made fully aware of what a product or service is, your customers could end up spending money on something they didn’t even need. Such experiences could cause your customers to garner a feeling of resentment and could potentially harm your relationship with them. Make it a point to clarify any detail that the customer finds hard to comprehend and always, always use Layman’s terms when explaining it to your customers.

Reward Engagement

In the highly competitive world we live in today, it is next to impossible to be successful simply by offering quality products and services. There is always that one guy (company) who is ready to give the same product/service at a lower cost just so that they can get the business. At this point, you need to consider ways to encourage your customer to choose you over your competition. The reward or offer you extend to your customers should be enough to make the customers take the desired action.

When creating offers for a financial service provider, it is always best to give the offer to the product/service already held by the customers. Why? Because banking concepts can be hard to wrap your head around, and when you offer something new to the customer, it is not necessary that the customer understand what it is or how it can benefit him/her. On the other hand, if the offer is for a product/service they are already familiar with, then they know exactly what you are offering.

Multi-Channel Approach

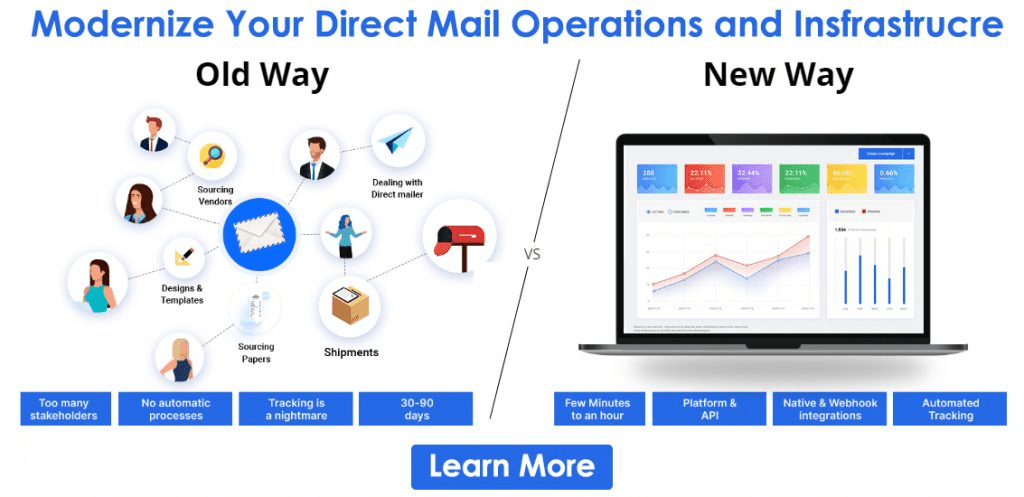

Direct mails and phone calls are two of the highly effective ways for building a healthy and engaging relationship with your customers. However, the time has changed, and throughout the years, we have incorporated modern techniques into our efforts to reach out to the customers more effectively. Mobiles are a great way of reaching the new-age man, and even though the traditional approach still remains most effective, incorporating mobile into your existing system can do wonders for your business.

There are a number of ways you can combine multiple channels for effectively engaging with your customers. For example, consider including a QR code in your direct mail that further leads to a personalized offer to your customers. This means that you can pretty much use all sorts of content, including videos or even interactive questionnaires. Furthermore, with advanced direct mail solutions available in the market, such as PostGrid, you can streamline your customer engagement strategies by automating the whole process.

Keep Continuous Communication

More often than not, your customers will not react to your initial message. They may need one or more alternative forms of communication to take action, and you may even have to throw in some offer as an encouragement. This further raises the significance of digital retargeting and sequential communication. Digital retargeting does not necessarily have to be for your existing or past customers. You can even use it to reach out to visitors who have been to your website but left without taking the desired action.

One of the really intriguing retargeting methods popular today is the one that comes with the ability to retarget customers to whom you have sent a direct mail but also want to reach them digitally via their computers or smartphones. The response rate can be greatly boosted by combining multiple channels, as stated above. This can also greatly influence your customer engagement strategy because of its superior convenience.

Test, Learn, Test

There is no cheat code that you can use to reach your customer engagement goals in banking. The unique nature of their market areas, customer profiles, competition, and product line make it next to impossible to develop a strategy that can work effectively for every financial service provider. However, that does not mean you can not come up with the right strategy by yourself as long as you keep on testing and learning from each step you take.

Conclusion

Customer engagement in banking is perhaps one of the most challenging ones you will encounter. You can not hope to get the best result by diving headfirst into the customer engagement activities in banking. There are various methods to reaching out to your customers, and the most effective one still remains the traditional direct mail for the banking sector.

However, an even better approach would be to incorporate both offline and online mediums to enhance customer experience and engagement. As long as you keep the tips mentioned above and use advanced tools like PostGrid in your customer engagement strategies, you can create an ecosystem filled with customers engaged in your banking service business.

Ready to Get Started?

Start transforming and automating your offline communications with PostGrid

The post Customer Engagement Strategies in Banking appeared first on PostGrid.

Article Source : www.postgrid.com/customer-e...