Onboarding vs. Implementation: Do You Need Both?

- 9 Min read

Gartner says that companies are working hard to make customers happier with their experiences. Customers now expect companies not only to understand their needs but also to predict them. But there is a question many people have: how can businesses tell if the things they do to help customers are working?

Customer success metrics help companies see how well they are doing with customer relationships and can also help them grow their business health. The topic of “customer success” is currently quite popular. Forecasts indicate that the worldwide demand for customer success platforms will increase by more than 20% by 2026, to a total of $3.1 billion.

In this article, we will cover the essential customer success metrics and KPIs you need to track for a better CS operation.

Customer Success Key performance indicators (KPIs) are the quantitative expressions of the customer’s progress in adopting and using a product and recommending it to other potential users. Customer metrics indicate the performance of the customer success team and the efficiency of your customer contact and support channels.

They are fundamental to establishing processes that maximize your customer relationships’ lifetime value. When properly tracked, customer success managers can get insights into critical areas like churn rate, adoption rate or product satisfaction, which can help you make better business decisions about how to enhance products and services to attract and retain more customers.

Now, let’s take a closer look at customer success metrics.

There is a vast sea of possible ways to measure customer success for your company. It is contingent upon a variety of factors, including your desired outcomes, the nature of your business and sector, the level of development of your customer success department and so on. Due to the fact that various companies place a higher or lower value on various elements of the customer lifecycle, their success criteria for customers will naturally vary.

So, where do you start? First, take a look at our list of the most important metrics to consider.

NPS is used to measure overall customer satisfaction. It’s also a good indicator of brand loyalty. This simple survey has a much higher level of customer engagement than most other feedback surveys.

The Net Promoter Score (NPS) is an indicator of future business development and customer loyalty. By creating a feedback loop between clients and your business, NPS allows for direct customer satisfaction measurement as well as valuable insights into areas requiring improvements for optimal customer experiences.

This metric is popular because it is easy to measure and understand. Here’s what you should do to calculate your Net Promoter Score.

Businesses take this data and assign names to different groups of respondents. Those who click 0-6 are called “detractors,” those who click 7 and 8 are “passives” and those who click 9 and 10 are “promoters.”

After the survey scores are grouped, you can calculate the Net Promoter Score. The NPS calculation is done by subtracting the percentage of promoters from the percentage of detractors. The result gives your business a Net Promoter Score.

According to Bain & Company, the creators of NPS, any result above 0 is considered okay, above 20 is considered favorable, above 50 is excellent and a score above 80 is considered “world-class.”

This is one of the customer success manager’s metrics. It provides an estimate of how much money a typical client will spend on your products over the course of their lifetime with your company.

If a Customer’s Lifetime Value goes up as they continue to use your product, it’s because they’re satisfied with it, which means your profits rise. If, on the other hand, CLV is dropping, you may want to investigate what factors may be reducing your product’s value or benefit over time.

The CAC is the cost to acquire a new client. This metric usually includes costs like promotion, research and even getting new SaaS users up and running. It can also include the salaries of your marketing and sales staff.

Measuring your CAC is pretty simple: divide the total number of sales and marketing costs of your product by the number of new customers acquired over a certain period.

Once you have this number, you can determine your CAC payback period (how long it will take to recoup your CAC investment). Additionally, you won’t know for sure if your subscription marketing plan is successful or not unless you look at this value.

Using the Customer Lifetime Value metric in conjunction with this customer success KPI yields the greatest results. You can then compare the two and see how much profit you get from each of your consumers.

Understanding your churn rate is like taking a new angle on retention. As an alternative to customer retention, the churn rate measures the amount at which consumers leave your service over a certain time frame (often one month).

Depending on the industry, it can be difficult for customer success teams to detect churned customers. Typically, businesses may label a client as “churned” if they haven’t made a purchase in a while. In general, the metric shows how many clients have quit working with you.

Your Customer Satisfaction Score (CSAT) is also based on customer feedback. However, the main difference between this and NPS is that CSAT is considered a short-term evaluation of customer satisfaction useful for targeted improvements, while Net Promoter Score is much of a long-term indication of customer loyalty.

A high Customer Satisfaction Score presupposes high customer loyalty—and thus an opportunity for further customer acquisition.

This metric is all about how your customers rate their experience with your business. This score can be pretty flexible and includes many different aspects, depending on what questions and rating scales you use.

This customer success metric can help you improve client experience and start inspiring brand loyalty. In addition, it is simple to use, efficient and useful for analyzing how you interact with individual customers.

The Customer Effort Score can show how much effort it takes for your client to get their issue resolved, purchase a product or get their question answered.

Knowing the Customer Effort Score might help your business deliver better service to its clientele. Customers are more loyal to businesses that make their lives easier, which in turn improves customer service, cuts expenses and reduces turnover. As a result of these reasons, it is one of the most significant metrics for measuring customer satisfaction.

The Customer Health Score reflects whether or not a customer values the product or service provided by the company and makes regular use of it. This metric, which is mostly used by SaaS businesses, gives customers a score based on how likely they are to stay with the brand and grow with it or leave.

A “healthy” customer is one who is satisfied with your product, uses it frequently, has full access to all of its features, recommends it to others, and is unlikely to leave. An unhealthy user, on the other hand, might be unhappy with your product and use it less and less. They might even be thinking about switching to a different brand.

Customer Health Scores should be monitored so the team knows when to intervene. It alerts them that this particular consumer requires attention and specifies the type of assistance that would be most useful.

Different businesses, especially if they come from different industries, will measure the Customer Health Score in different ways. However, there are two tips you should consider when creating your ideal set of health metrics:

The rate at which a corporation is able to keep its existing clientele as paying clients is known as its Customer Retention Rate.

The cost of acquiring a first-time buyer is five times higher than the cost of retaining a repeat one. These numbers highlight the need for businesses to prioritize customer retention as a key marketing objective.

Once you know the percentage of your consumers that your firm manages to keep, you can concentrate on increasing customer service and overall retention. Find out how satisfied your current customer base is with your brand using this measure. It can also help you boost your customer health score and brand image and bring in new customers from referrals.

Customer Retention Cost is also one of the most fundamental customer success metrics to ever exist. The CRC measures how much it costs to keep an existing client as a paying one. A company’s success is dependent on more than just adding new consumers every month.

If your marketing campaign turns out to be ineffective, then you can risk losing money. Therefore, a loyal customer base is a cornerstone for financial stability and your business’s long-term health. Once you calculate Customer Retention Cost, you can make wise judgments on how much you should reserve for your marketing budget and keep loyal consumers.

This metric measures the amount of money your customers are spending on your products and services each month. Your MRR (Monthly Recurring Revenue) can tell you if their spending has increased since they began working with your company. This statistic is also useful for finding out if your products are meeting the needs of your clients. The MRR is a helpful metric for subscription-based businesses like SaaS.

To find out how many clients had their issues handled after their initial contact with your company, you can calculate the First Contact Resolution Rate (FCR). If you want to know how well your support team is doing, this is one of the most important customer success indicators you can track.

All first-contact inquiries into customer service (by phone, chat or social media) that were resolved by your staff are factored into the resolution rate. In the absence of further complaints from the customer, the initial point of contact is considered successful in resolving the problem.

In most cases, increased customer happiness and loyalty follow from a high First Contact Resolution Rate. And it’s been known for a long time that keeping existing consumers means a lot less money spent on advertising to find new ones.

NRR measures how much of your monthly recurring income comes from your existing customers. It assesses how good the company is at sustaining its client base and developing those clients. Out of the many customer success KPIs companies use to measure company financial performance, NRR is the most popular one, mainly because it gives you a complete overview of your active subscriptions as well as the total revenue derived from them.

An acceptable NRR for a SaaS business is greater than 100%, but highly successful ones can achieve NRRs of up to 140%. However, the average NRR for a small to medium-sized business is 90%. If it drops below that, something isn’t functioning as it should.

Average Revenue per User (ARPU), also known as Average Revenue per Account (ARPA), is the average revenue received per user over a period of time (a month or a year). It is a metric commonly used by SaaS, digital media, social media and telecommunications companies. This metric helps your business identify purchasing trends for various user groups over different periods. ARPA provides invaluable insights into your company’s profitability, performance and strengths.

Quality Customer Feedback enables you to achieve valuable data and insight into why customers provided negative or positive feedback about your service or product.

There are plenty of ways to gather the information. For example, social networks, survey forms or discussions with the customer support team. This way, your customers can explain why they have given a specific score. It can be a follow-up question written on an NPS survey or verbally in a check-in phone call. Once the Qualitative Customer Feedback data is collected, it can be analyzed using text analytics. This will show what is most important about an item by measuring different levels of satisfaction.

Renewal Rate is an important metric for SaaS companies. Since most SaaS companies operate on subscription models, it is important to know how many customers sign up and renew their subscriptions.

This metric provides opportunities to learn what works and what to change or which surveys to use to get more insights on how to make customers happier.

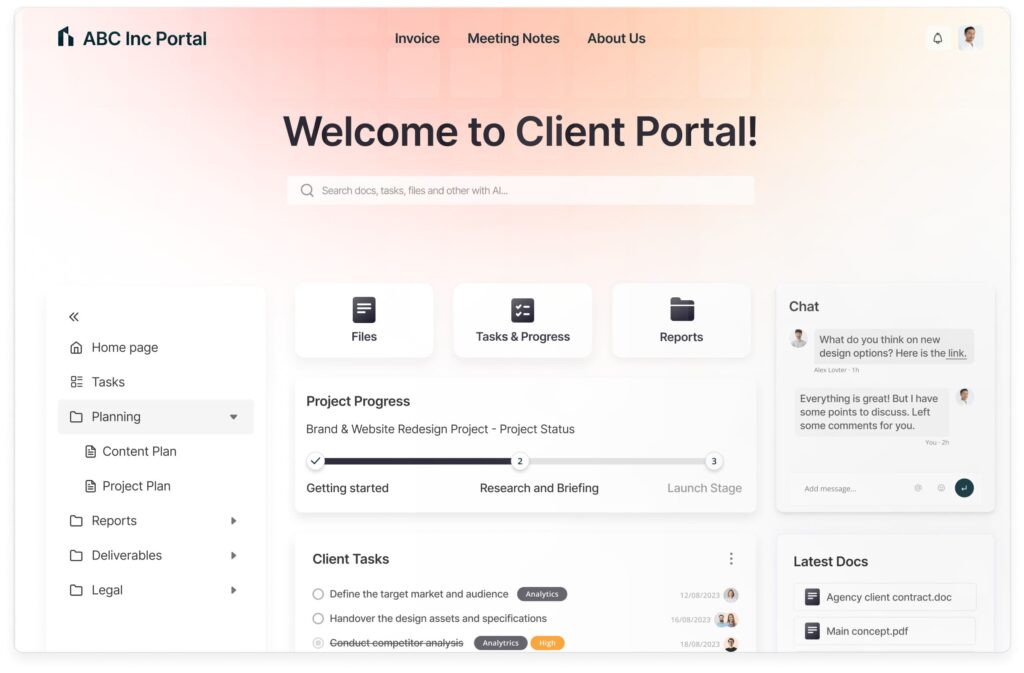

Once you’ve identified your most crucial customer success metrics to track, the next step should be deciding how you’ll do this. FuseBase provides the ideal platform for this – featuring collaboration, knowledge sharing and content management, as well as numerous features designed specifically to optimize the customer success program:

There are numerous customer success metrics that can assist your organization with keeping customers satisfied and engaged with its product or service. When selecting metrics to track customer success for your organization, be sure to monitor them frequently so you get accurate measurements over time and gain accurate data for analysis purposes.

However, manually keeping tabs on these KPIs can be a tedious and error-prone process. Customer success software can make all the difference in this situation by giving you the tools you need to handle your relationships with customers wisely and proactively.

FuseBase provides an ideal means of starting to improve your customer success strategy. It serves all your customer success requirements with its user-friendly interface, powerful customization features and analytics features, providing the complete package to address customer success challenges and needs.

Implement customer success metrics using FuseBase!

Found it useful? Share the article with your community

Get weekly tips and insights on how to grow your business